An examination of the trends and use cases of AI and big data technologies in investments

In this report, we seek to identify high-impact applications of artificial intelligence (AI) and big data in investments and best practice in their implementation by examining specific use cases. For this purpose, we conducted interviews with investment industry practitioners around the world and from different areas of investments, mostly in April and May 2019.

We found that relatively few investment professionals are currently exploiting AI and big data applications in their investment processes. To provide a guidepost for investment firms and individuals seeking to move toward the latest technological frontier, we spoke with a selection of institutions across the globe that are currently using these technologies; these are among the AI pioneers in investment management.

Their use cases are illuminating. Among other things, they underscore the opportunities but also the limitations of AI and the continued important role of human judgment in investment processes.

We ascribe to the power of the “AI + HI” model: AI techniques can augment human intelligence to enable investment professionals to reach a higher level of performance, freeing them from routine tasks and enabling smarter decision making that leverages the collective intelligence of machines and humans.

Successful investment firms of the future will be those that strategically plan on incorporating AI and big data techniques into their investment processes. Successful investment professionals will be those who can understand and best exploit the opportunities brought about by these new technologies.

The future is here.

Highlights of the Report

In the report we identify three types of AI and big data applications in investment management:

- Using natural language processing (NLP), computer vision, and voice recognition to efficiently process text, image, and audio data;

- Using machine learning (ML), including deep learning, techniques to improve the effectiveness of algorithms used in investment processes;

- Using AI techniques to process big data, including alternative and unstructured data, for investment insights.

According to a CFA Institute survey, relatively few investment professionals are currently using AI/big data techniques in their investment processes. Most portfolio managers continue to rely on Excel and desktop market data tools; only 10% of portfolio manager respondents have used AI/ML techniques in the past 12 months.

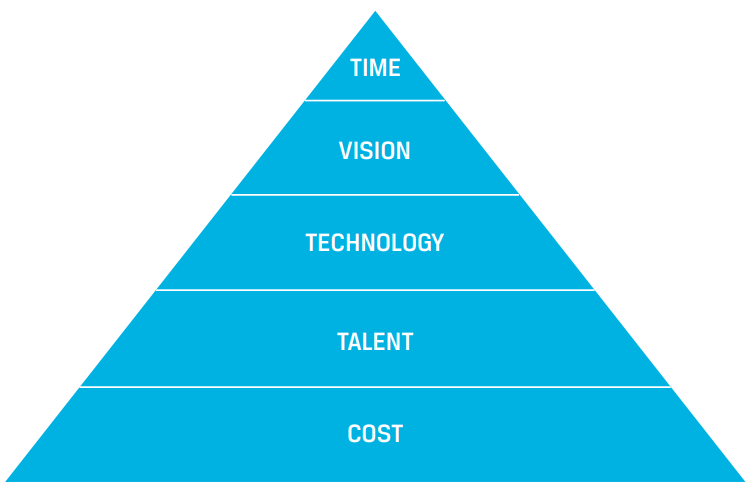

We identify five major hurdles to successful adoption of AI and big data in investment processes: cost, talent, technology, leadership vision, and time. Investment firms will need to substantially overcome the five hurdles to reach the top of the fintech pyramid.

Key Takeaways

- The decision to use AI and big data techniques should be benchmarked against the performance of traditional techniques. Firms should determine whether the potential additional alpha capture is worth the additional cost and complexity of applying AI and big data.

- A machine is only as intelligent as the data it learns from. The more comprehensive the training data, the more generalized the machine will process new events, thereby mitigating common pitfalls like overfitting.

- Machine Learning (ML) techniques are more suited to systematic strategies (including rules-based, quantitative strategies), and unstructured and alternative data are typically used more by discretionary (active) managers.

- Niche, sector-specific data sets are of more relevance to a fundamental analyst or portfolio manager searching for alpha than a systematic manager.

- The effective use of such data sets could provide one of the biggest opportunities for a besieged active management sector.

- AI and big data are no panacea; they cannot solve every investment problem. For example, only a small proportion of big data can generate meaningful signals; reliably extracting signal from noise is difficult.