Addenda Capital uses impact investing to support the goal of achieving a net-zero emissions society by 2050. Every investment is subjected to in-depth fundamental research and analysis and then evaluated according to the firm’s impact criteria.

This case study from Addenda Capital originally appeared in the CFA Institute report "Climate Change Analysis in the Investment Process."

Impact Investing

Impact investing, as practiced at Addenda Capital, is an investment approach that seeks to generate both compelling financial returns and positive, measurable social and/or environmental effects.

Impact investing is not the same as sustainable investing, which integrates ESG considerations into investment and stewardship activities, with a focus on generating superior risk-adjusted financial returns. The key differences between sustainable investing and impact investing are intentionality and measurability. Impact investments are made with the intention of generating a positive impact, and those positive impacts must be measured.

In addition to conducting financial and investment analysis that incorporates ESG considerations, we subject each impact investment to an impact evaluation. We first apply the same in-depth fundamental research and analysis used for all of our investments. We then evaluate each security against the criteria we have established for each of our impact focus areas.

Identifying Investments with Positive Climate Impacts

We use 4 impact investing themes with 10 underlying focus areas. Climate change, the largest theme, has three focus areas: renewable energy, clean transportation, and energy efficiency.

Each focus area in the climate change theme has a written summary that outlines the following:

- the societal challenges associated with climate change;

- how investments in the focus area will help address those challenges;

- linkages between the focus area and the UN Sustainable Development Goals;

- likely impact metrics;

- the criteria that must be met in order to be considered an impact investment in that focus area; and

- a reference to a widely accepted authority or standard that establishes that the impact generated by the investment will be positive.

Each summary must be approved by at least two-thirds of Addenda’s Sustainable Investing Committee prior to investment in that focus area.

Addenda’s sustainable investing team has the mandate to review each possible impact investment to ensure it meets our established criteria.

For climate change impact investments, we seek investments that are aligned with, or supportive of, the transition to a resilient, net-zero emissions society by 2050. In addressing the challenges associated with climate change, we refer to widely accepted authorities or standards that have attempted to establish which activities are necessary and sufficient to support the needed transition. For instance, we refer to the Climate Bonds Initiative’s Solar Energy and Wind Energy Criteria for our renewable energy focus area and its Low Carbon Buildings Criteria for our energy efficiency focus area.

Green Bonds — Independently Verified or Second-Party Opinion?

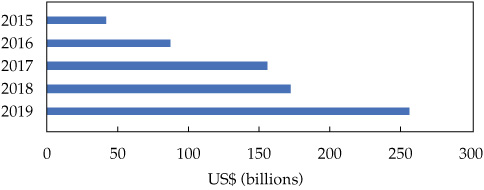

In recent years, the issuance of “green bonds” as labelled by their issuers has grown steadily (see Figure 1). Unfortunately, the green bond label does not always reliably indicate whether the use of proceeds will actually support the needed transition. We assess each investment, even those investments already labelled as green, against our established criteria for each focus area.

Figure 1. Annual Green Bond Issuance

Source: Climate Bonds Initiative.

In some markets, many issuers have their labelled green bonds independently verified against rigorous standards that meet our own criteria and give other investors confidence that the use of proceeds will help address the challenges associated with climate change. For example, in 2018, 83% of the value of green bonds issued in Australia were certified under the Climate Bonds Standard.1

Another common practice is for issuers to obtain a second-party opinion regarding their green bond program. For example, in 2018, 100% of the value of green bonds issued in Canada had a second-party opinion.2 These second-party opinions tend to focus on the green bond program’s alignment with the International Capital Market Association’s Green Bond Principles and the issuer’s sustainability practices, however, rather than its alignment with the use of proceeds for climate transition. Therefore, it is important for us to review the use of proceeds to ensure they meet or exceed our criteria.

Climate Reporting Is Mandatory

For all impact investing mandates, at least one positive environmental or social impact must be measured and reported to clients annually. This procedure applies to each security within the mandate. Metrics can include tonnes of greenhouse gas emissions avoided, megawatt hours of electricity generated renewably, and kilometers of electricity transmission lines dedicated to moving renewably generated electricity. Exhibit 1 offers some example metrics.

Exhibit 1. Climate Reporting Examples

|

The Whitby Rail Maintenance Facility, one project financed in part by the Province of Ontario’s fourth Green Bond, is estimated to have reduced greenhouse gas emissions by 2,093 CO2e/year.3 |

The purchase of new subway cars, one thing financed in part by Quebec’s Green Bonds, is estimated to have already contributed to the reduction of the greenhouse gas emissions per passenger-kilometer of Montreal’s transit system by 6%.4 |

Incorporating Positive Climate Impacts into Fixed-Income Portfolios

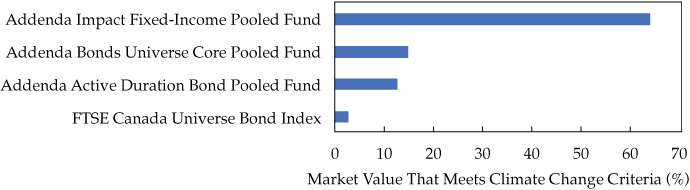

Addenda manages a variety of fixed-income mandates, some of which explicitly prefer positive impact investments. Clients in our Impact Fixed-Income Pooled Fund want a portfolio consisting entirely of impact investments, and climate change is the dominant theme for that investment strategy. On the other end of the spectrum, we work with clients that have not specified a preference for positive climate impact investments, such as those in our Core or Active Duration Bond Pooled Funds. Many of these clients would prefer to invest in those bonds, all else being equal, and so we strive to increase their exposure to positive climate impact within the frameworks of our existing investment processes. Through these efforts, we have greatly increased our clients’ exposure to positive climate impact relative to the exposure available in the benchmark (see Figure 2).

Figure 2. Exposure to Positive Climate Impact Investments

Note: As of 31 March 2020.

Sources: Addenda Capital; FTSE.

The Case for Pursuing Positive Climate Impacts

Although it may seem at times that climate change is primarily a risk to be identified and mitigated in existing investment processes, remember that opportunities exist to provide financing for entities that are taking actions to avert the worst consequences of climate change. The generation of investment returns and social value do not have to be mutually exclusive. It is not only possible but also important to invest in entities that will help us make the transition to a resilient, net-zero emissions society by 2050.