To assess companies’ climate-change exposure, investors need a comprehensive carbon measurement method that will allow them to manage transition risk exposure, capture climate-related opportunities, and improve the impact of issuer engagements.

This case study from Mirova originally appeared in the CFA Institute report "Climate Change Analysis in the Investment Process."

Introduction

Whether they are inspired by financial materiality, active ownership, risk mitigation, regulatory risk, or a desire to create a positive impact, investors are beginning to think about climate change within their investment processes.

Looking at an asset or portfolio’s direct emissions or share of climate-friendly revenues might not be enough, however, to effectively measure its exposure to climate risks and opportunities. Asset class, sector allocation, and a company’s products, processes, and strategy can play decisive roles in determining its climate profile. At Mirova, we believe that methods for measuring and managing climate concerns within investments must account for these nuances.

With these variables in mind, Mirova saw the need for a method that assesses each company’s products and processes in a way that is applicable and comparable across asset classes. Since 2015, we have partnered with Carbone4, a consulting firm focused on low-carbon strategy, to create a dataset that allows us to both:

- reduce climate risk by identifying the assets most likely to be exposed to climate change–related risks (namely, greenhouse gas emissions); and

- capture climate-related opportunities by creating a metric that illustrates to what extent an asset creates climate benefit through low-carbon or energy efficient products and how it might benefit from the transition to a low-carbon economy.

Financed Emissions and Emissions Savings

Two types of emissions are relatively easy to measure and have widely available data: direct emissions from fossil fuels burned on company premises (Scope 1) and emissions from electricity or heat that a company uses in the course of business (Scope 2). Because these data are so easy to access, investors looking to assess and/or improve their investments’ climate profile have mainly used these types of emissions in their analyses.

We are convinced, however, that going beyond direct emissions is essential to create meaningful climate-friendly investment products. Accounting for raw material extraction, transportation, and final use of products is essential because these life-cycle “Scope 3” emissions dwarf Scope 1 and Scope 2 emissions in several key sectors. The use phase of an oil company or automobile manufacturer’s products, for example, constitutes 80% of their carbon impacts. Ignoring Scope 3 emissions can thus obscure a portfolio’s exposure to transition risks related to climate change, as well as its broader climate profile.

Our analysis has suggested that relying only on Scope 1 and Scope 2 emissions data can produce portfolios and indexes that do not live up to their climate-friendly claims. Once Scope 3 emissions are accounted for using a life-cycle approach, “low carbon” indexes based exclusively on direct and electricity emissions often have carbon footprints very similar to their traditional counterparts (i.e., those with no carbon considerations). For example, some of these indexes include a consequential share of oil majors that have made small reductions in their operational emissions without addressing the inherent incompatibility between the fight against climate change and the company’s existing business model.

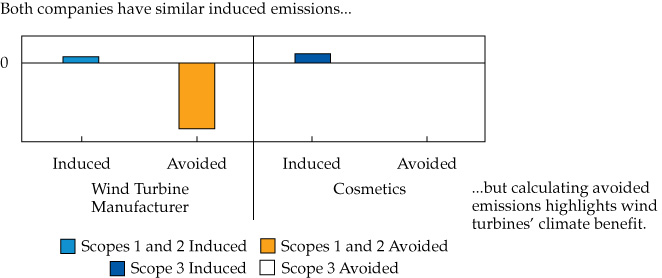

Induced emissions—the real emissions created by a company or asset across all three scopes—can represent exposure to climate transition risk. Emissions saved—the emissions avoided by a company’s products or processes relative to a pertinent baseline—can indicate a company’s or portfolio’s exposure to opportunities in energy transition. Both measures are necessary—if we look only at induced emissions, two companies with similar life-cycle carbon emissions may be indistinguishable, even if one provides technological solutions instrumental for mitigating climate change and the other provides a product with low or no added value for the climate. When saved emissions are considered alongside induced emissions, the company’s total contribution to climate change mitigation becomes clear. Figure 1 illustrates the issue with an example.

Figure 1. Emissions Comparison for Cosmetics Company and Wind Turbine Manufacturer, 31 October 2019

Source: Mirova/Carbone4.

Although reporting Scope 1 and Scope 2–induced emissions is relatively straightforward, considering the full life cycle of emissions (both induced and saved) can prove challenging from both philosophical and analytical perspectives. Because these assessments rely on estimates, uncertainty is involved. But gaining a sense of the magnitude of a company’s emissions financed versus saved can be more telling than very precise figures that fail to tell the whole story. We have shifted from disclosure-oriented to performance-oriented carbon data.

Aligning Portfolios with Climate ScenariosAligning Portfolios with Climate Scenarios

Today, our partner Carbone4 provides us with a database of financed and saved emissions for each company we cover. Each company’s individual carbon assessment is aggregated at the portfolio level and reprocessed to avoid double counting. Once aggregated, a portfolio’s coherence with various climate scenarios is estimated on a scale from 1.5°C to 4.5°C (degrees of associated global temperature increase) using investment projections from the International Energy Agency and the Intergovernmental Panel on Climate Change.

- A 1.5°C–2°C portfolio finances a high level of solutions providers relative to emissions produced. It implies substantial policy action and mitigates the transition risk associated with an economy aligned with 2°C of warming or less by 2100 by reducing the quantity of emissions it finances. Such a portfolio captures mitigation opportunities linked to achieving this goal by investing in assets that provide products or services that reduce the economy’s greenhouse gas intensity.

- A 4.5°C portfolio is in line with the continued growth of greenhouse gas emissions and limited political action, implying severe, long-term, global climate consequences, high risk for the portfolio, and limited exposure to climate-related opportunities.

This method assesses equity portfolios and indexes without explicit climate considerations to align with a 3.5°C–4°C rise in global average surface temperature, in line with long-term emissions growth and limited policy action: the status quo scenario.1 For example, as of 1 May 2020, we calculate the S&P 500 Index to be aligned with a 3.8°C global warming trajectory.

Although the carbon metrics and temperature indicator we have developed with Carbone4 offer a telling and concise way to communicate and monitor a portfolio’s exposure to climate risks and opportunities, we believe that mitigating climate change today means mitigating an enormous and uncertain risk to investments over the long term. As such, we consider developing meaningful and robust emissions data to be a first step for investors. The second step is integrating these data into the investment process.

Using Climate Data in the Investment Process

In 2015, Mirova set a target to align all of our portfolios with a 2°C scenario based on the method we developed with Carbone4. As an example, at the outset, we assessed our consolidated equity portfolio to be in line with a status quo scenario: 3.1°C. Over time, by integrating climate change into every step of our investment process, we have reduced this level to 1.5°C.

We achieved this goal by identifying thematic investments related to climate change mitigation and adaptation and then analyzing climate risks and opportunities as an essential part of company fundamentals. We have worked to create ambitious low-carbon portfolios and indexes, and we have formally incorporated emissions data into our portfolio risk metrics. In valuation, we account for higher costs of capital for emissive companies.

There are nevertheless many other methods for incorporating climate considerations in investment processes. We believe that all have their merits, as investors who consider the full life-cycle climate performance of investments can experience less long-term vulnerability (and potentially an information advantage relative to investors looking exclusively at operational emissions).

At Mirova, we are convinced that a comprehensive carbon measurement method that emphasizes both life-cycle-financed emissions and emissions savings is essential for managing transition risk exposure, capturing climate-related opportunities, and improving the impact of issuer engagements. We believe that by working to align assets and portfolios with a 1.5°C climate trajectory and systematically considering climate change within the investment process, investors can increase the climate resilience of their investments, their business, and the planet.

© 2020 Mirova. All rights reserved.