The real estate sector consumes the most energy and accounts for the most emissions. The Afore XXI Banorte portfolio follows a climate strategy for the real estate sector that combines sustainable goals with a focus on improving investment returns.

This case study from Afore XXI Banorte supports the CFA Institute report "Climate Change Analysis in the Investment Process."

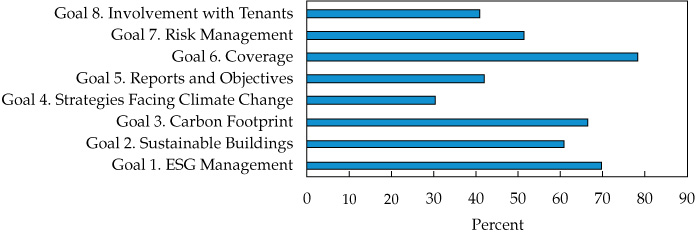

According to the 2020 Global Status Report for Buildings and Construction, published by the Global Alliance for Buildings and Construction (Global ABC) and the United Nations Environment Programme (UNEP), the real estate sector consumes the largest amount of energy worldwide. It demands around 35% of the world’s total consumption, and it also emits the most greenhouse gases (GHGs), contributing 38% of the total. Figure 1 illustrates global energy use and emissions by sector.

Figure 1. Global Share of Buildings and Construction Final Energy and Emissions, 2019

Source: Global Alliance for Buildings and Construction and United Nations Environment Programme “2020 Global Status Report for Buildings and Construction” (2020). https://globalabc.org/sites/default/files/inline-files/2020%20Buildings%20GSR_FULL%20REPORT.pdf.

In response to and in accordance with the recommendations of the United Nations’ Principles for Responsible Investment (PRI), we have developed a climate strategy that includes sustainable goals for the real estate sector. Our strategy derives both from the current composition of our portfolio and from meeting our fiduciary duty to actively identify and manage the environmental, social, and governance (ESG) risks related to climate change as part of our decision-making and management processes.

Based on evidence in several countries that an environmentally friendly and sustainable real estate sector can preserve and increase assets’ value,1 we believe material opportunities exist to improve investment returns. Indeed, as the academic evidence reflects, the relation between sustainable construction characteristics and the return on investment is reciprocal. According to the US Green Building Council (USGBC),2 investment managers report a 19.2% ROI after remodeling and implementing green technologies in properties and a 9.9% ROI in green-certified buildings since their construction. Buildings that lack such characteristics in some cases may suffer a “discount” in their valuation, compared with a valuation increase of up to 10% in the buildings that do have them.3 Therefore, we believe that how we manage our real estate investments is of crucial importance, from a financial perspective as well as a social one.

For this reason, the goals that we design for the Afore XXI Banorte portfolio refer to the typology of climate risks and their potential impact in the real estate sector according to the Urban Land Institute.4 We then align these goals with possible commitments or mitigation and adaptation measures that project administrators could implement to face these types of risk.5

These goals have the following general objectives:

• To reduce energy consumption and GHG emissions in the real estate sector of the projects in our portfolio and, by doing so, to support the compliance of the Mexican National Democratic Congress (NDC) with the Paris Agreement6

• To encourage mechanisms to manage physical and transitional risks that can affect investment returns and decision-making processes

• To encourage material improvements in the assets’ value, as well as long-term risk reductions that can be achieved at limited cost through integrating ESG and climate risks into real estate investments

• To encourage the acceptance and implementation of the PRI in the real estate sector

To work toward these goals and as part of our Policy for the Management of Climate Change of the Portfolio, we designed the following set of sustainable goals for our real estate sector portfolio:7

1. ESG management: ESG-related policies, programs, initiatives, or projects

2. Sustainable buildings: Buildings with environmental certifications8

3. Carbon footprint: Incorporation of clean technology and/or renewable energy to reduce the carbon footprint

4. Strategies facing climate change: Strategies and processes to mitigate risks from events derived from climate change

5. Reports and objectives: Documentation of ESG-related risks and/or opportunities by the final decision-making authority

6. Coverage: Coverage against damages caused by climate change or green investments that help mitigate climate change

7. Risk management: Within our risk analysis, the consideration of climate change and resulting events or the identification of areas vulnerable to climate change

8. Involvement with tenants: Training on energy and water efficiency, as well as measurement of energy and water consumption

After defining these eight goals, we established an April 2020 start date as a baseline for our real estate portfolio. At that time, we measured portfolio compliance with the goals at 23%. We met with all the real estate asset managers of our portfolio to inform them about the established goals and the status of each one, in addition to communicating the process for follow-up and annual monitoring on the degree of achievement and progress toward meeting these objectives.

Annually, through individual questions on our “Sustainable Goals of the Real Estate Sector” questionnaire, we request information corresponding to each objective from the administrators in this sector. Subsequently, we weight the responses based on our own methodology to obtain an individual compliance percentage for each administrator, based on their goals and also compared with the total portfolio.

For the strategy’s monitoring, follow-up, and implementation, Afore XXI Banorte established two stages with respective objectives:

• Stage 1: In 2025, reach at least 50% of global compliance with the portfolio goals.

• Stage 2: In 2030, reach at least 80% of global compliance with the portfolio goals.

The current results of monitoring compliance with our sustainable goals for the real estate portfolio appear in the appendix. Our next step is to confirm the veracity of the disclosed information, with the help of evidence and direct involvement with the administrators, in addition to obtaining specific commitments for progress and fulfillment of the objectives. This process will evolve over time in response to constant changes within the industry (e.g., updates in construction materials, technologies, and certification frameworks) and as implementation progresses for sustainable strategies around the world. Our challenges will be to redesign and strengthen our goals through science-based objectives, as well as for the companies in which we invest to adopt and publish quantitative indicators and a schedule for reducing Scope 1, 2, and 3 GHG emissions.

Appendix: Current Status (2020–2021)

Table A1. Sustainability Goals

|

|

Year |

Current |

Objective |

|

Baseline |

2020 |

23% |

|

|

Stage 1 |

2025 |

|

50% |

|

Stage 2 |

2030 |

|

80% |

Table A2. Growth in Compliance from Each Issuer, 2020–May 2021

|

Issuer |

Baseline 2020 |

2020–2021 |

|

1 |

38% |

89% |

|

2 |

25 |

84 |

|

3 |

25 |

83 |

|

4 |

38 |

82 |

|

5 |

25 |

80 |

|

6 |

75 |

80 |

|

|

|

|

|

7 |

38 |

75 |

|

8 |

50 |

70 |

|

9 |

13 |

60 |

|

10 |

13 |

67 |

|

11 |

38 |

64 |

|

12 |

38 |

52 |

|

|

|

|

|

13 |

0 |

49 |

|

14 |

13 |

44 |

|

15 |

25 |

43 |

|

16 |

13 |

40 |

|

17 |

13 |

40 |

|

18 |

25 |

40 |

|

|

|

|

|

19 |

0 |

38 |

|

20 |

13 |

32 |

|

21 |

0 |

28 |

|

22 |

13 |

17 |

|

23 |

0 |

8 |

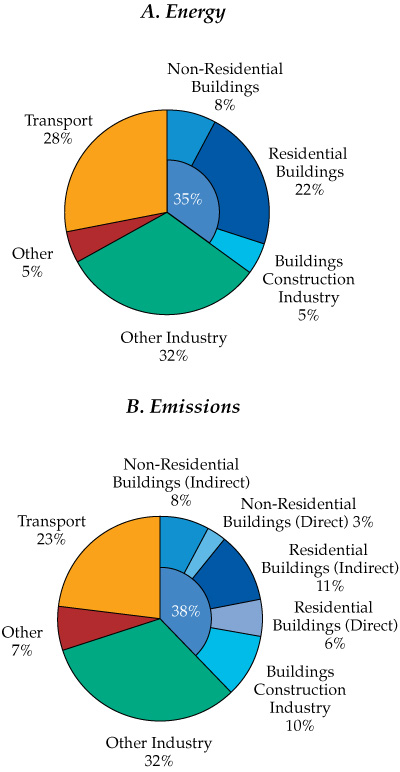

Figure A1. Percentage of Portfolio Compliance by Goal, 2021