Can managers embed environmental, social, and governance (ESG) principles in the investment process and still provide superior risk-adjusted returns for clients? A large private alternative investment manager in Africa is working on the challenge.

This case study from Old Mutual Alternative Investments supports the CFA Institute report "Climate Change Analysis in the Investment Process."

In 2019, the Intergovernmental Panel on Climate Change (IPCC) published a special report on “Global Warming of 1.5°C.”1 The report was based on approximately 6,000 peer-reviewed publications, most of them published in the past few years. According to the IPCC, limiting warming to 1.5°C is possible but will require unprecedented transitions in all aspects of society. Overall, the report shows clear benefits to keeping warming to 1.5°C, rather than the limit previously thought safe, 2°C. The IPCC Sixth Assessment Report Working Group I contribution Climate Change 2021: The Physical Science Basis (see www.ipcc.ch/report/ar6/wg1/) was released in August 2021, with UN Secretary-General António Guterres stating the report was "a code red for humanity.’’

Throughout the COVID-19 pandemic, governments have, understandably, been focused on health, well-being, and economic impacts and recovery. However, we cannot delay in addressing climate risks.

Climate change is not a future event waiting to happen; it has already occurred and continues in real time. We are living it. A certain level of negative impact is already locked in. Climate risk actions are not about avoiding negative climate-related effects entirely but, rather, about reducing the negative effects as much as possible.

The 26th United Nations Climate Change Conference of the Parties (COP26) being held in Glasgow on 1–12 November 2021 will include a check on how countries have performed in terms of moving toward the Paris Agreement’s 2°C world. Will countries provide or not provide more ambitious “nationally determined contributions” as targets to tackle climate change? Either way, the pressure will remain on the private sector to demonstrate meaningful contributions to climate action. Climate action expectations and requirements of investors are evolving rapidly, with more and more regulations being passed and the Task Force on Climate-Related Financial Disclosures (TCFD) becoming entrenched as the framework of choice to manage climate-related risks.

The challenge, then, is how to assess climate risk and, more importantly, how to identify the point of certainty where findings will inform the investment decisions of investment committees. Old Mutual Alternative Investments is working on this challenge.

Old Mutual Alternative Investments (OMAI), with R59.76 billion (USD4.07 billion) under management as of 31 December 2020 in infrastructure, private equity, and impact investing, is one of the largest private alternative investment managers in Africa. We believe that embedding environmental, social, and governance (ESG) thinking into our investment decision making is critical if we want to create positive futures and sustainable, superior risk-adjusted returns for our clients. We seek to thoroughly understand the trade-offs posed by various investments, to be thoughtful in our investment decisions, and to act so as to be purposefully part of the solution to global ESG challenges. Climate change is one of four key focal points in OMAI’s strategy.

The OMAI Approach

In early 2020, OMAI began work on implementing the TCFD framework. The framework is composed of the following pillars:

- Strategy

- Governance

- Risk Management

- Metrics & Targets

The first step was to plot the logical progression of what the TCFD is hoping to achieve. Figure 1 presents that simple progression.

Figure 1. Steps toward TCFD Implementation

Our experience was that implementation of the TCFD framework was not exactly aligned with the documented TCFD pillars. The first step for OMAI was to establish the Governance pillar, because even decisions of TCFD implementation are subject to governance oversight and identification of the executive sponsors is critical for decision making. The next step was to establish the baseline and what detailed assessments (climate risk data and scenarios) were needed, which are aspects of the Risk Management and Metrics & Targets pillars. The baseline then informed the Strategy pillar. We then considered how the TCFD framework would be incorporated into our existing environmental and social management system (ESMS), which is responsible for the integration of ESG considerations into the investment process.

Implementing the Pillars

Governance

The first step was to address the Governance pillar of the TCFD by establishing which governance structures and individuals are key for climate risk management. OMAI governance forums are the funds’ investment committees, fund manager executive committees, fund manager boards, the OMAI risk committee, and the OMAI board. An important issue to consider was whether these governance structures were adequately staffed to consider climate-related risks.

Strategy

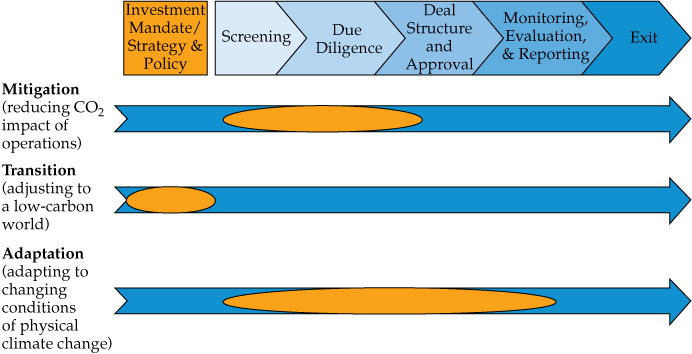

As indicated in Figure 2, in private market investments, much of the climate-related transition risk needs to be dealt with up front in the investment strategy of a fund by linking the fund’s mandate to identified climate risks and strategic outcomes. The reason is that much of the transition risk referred to in Figure 2 is driven by sector selection. Climate mitigation and adaptation analysis is dealt with through the investment process.

Figure 2. Climate Change Considerations in the Investment Process

Source: Ibis ESG Consulting, Climate Risk and TCFD: Data Sets and Tools Summary (2020).

Scenario analysis is a key part of the TCFD framework. Scenario analysis is the process through which one stress-tests the risks faced by an investment according to different possible future climate change trajectories (scenarios). OMAI is currently using the IPCC RCP 8.5 and 4.5 scenarios2 and the Network for Greening the Financial System (NGFS)3 Current Policies scenarios as the core scenarios for physical risk analysis. Most of the available open-source datasets use RCP 8.5 and RCP 4.5 scenarios. For transition risks, OMAI currently uses the NGFS disorderly scenarios of “Divergent Net Zero” and “Delayed Transition” and the orderly scenarios of “Net Zero 2050” and “Below 2°C.” Other scenarios are considered when we undertake a deeper analysis.

Energy transition is a key aspect of transition risk scenarios. African Infrastructure Investment Managers, the infrastructure fund manager of OMAI, appointed IHS Markit to undertake detailed, localised modelling of the energy systems of African countries in which OMAI is currently invested and is likely to invest in the future. The IHS Markit study provides forecasted energy-mix scenarios on a country basis, which establishes which scenarios (given affordability and the need to reduce carbon intensity) are the most efficient for the country.

Ibis ESG Consulting was then appointed to develop modelling for carbon budgets for the same countries. By pulling energy scenarios and carbon budget modelling together (considering IPCC global temperature increases of both 2°C and 1.5°C), OMAI can better understand energy transition risks and the headroom within carbon budgets to undertake Paris Agreement–aligned investments.

Risk Management

The Risk Management pillar considers the processes used to identify, assess, and manage climate-related risks throughout the investment cycle. Applying a materiality approach, OMAI undertakes a portfolio-level materiality assessment that uses a materiality matrix to identify those investments at highest risk from physical and transition effects. Prioritization allows a focused input into strategic decision making. Where high climate risks are identified, we undertake deeper investigation. The approach includes adequately identifying risks through due diligence and implementing portfolio-specific and company-specific actions to build climate adaptation and resilience.

OMAI uses various climate risk forecast data to identify, calibrate, and understand those risks for future climate scenarios and to implement appropriate actions. Through 2020, OMAI undertook an extensive review of physical climate risk data. The result of this process was the identification of five complementary physical risk data models and tools that are now used by OMAI. The models and tools are the World Bank ThinkHazard! tool,4 World Resources Institute Aqueduct tools,5 Climate Information Portal,6 Green Book (specific to South Africa),7 and Climate Impact Explorer.8

OMAI implements climate risk management through the OMAI ESMS as follows.

Screening phase

During the initial screening phase of the investment process, OMAI applies the materiality approach. We use the ThinkHazard! tool to screen and identify potential physical climate risks at an early stage, and we use established scenarios to identify potential transition risks. The outcomes of this screening process establish what climate-related investigations need to be undertaken in the due diligence phase. We include the findings in the first In-Principle Investment Committee meeting.

Due diligence

In the due diligence phase, OMAI uses other tools mentioned previously and scenarios to undertake a deeper assessment of physical and transition risks. We include the findings in the final Investment Committee presentation.

Transition phase

Through the transition phase of the investment, OMAI includes appropriate ESG and climate-related provisions in legal agreements and the environmental and social action plans where required.

Asset management phase

During active asset management, climate-related risks need to be monitored. OMAI updates the portfolio-wide materiality matrix to reflect material climate risks facing portfolio companies. In addition, OMAI ESG advisers meet regularly with asset managers to support the implementation of climate-related mitigation actions in portfolio companies. We also maintain an ESG “risk register,” where key ESG and climate-related risks are identified and mitigation actions are established and monitored. OMAI has begun looking at the investments’ financial models to value climate risk.

Exit phase

OMAI has established a “responsible exit” procedure for managing our exit from an ESG and climate risk perspective.

Metrics & Targets

OMAI has for the past few years identified and tracked key climate risk–related metrics aligned with the Greenhouse Gas Protocol,9 the IPCC, and the Sustainability Accounting Standards Board. An ESG data management system stores data and runs carbon footprinting, emissions reductions, and offset calculations. The following are the main climate-specific metrics tracked by portfolio company and aggregated at the fund level:

• installed capacity (gigawatts, GW),

• total energy produced (GW hours, GWh),

• nonrenewable energy produced (GWh),

• renewable energy produced (GWh),

• emission offset (tons of carbon dioxide equivalent, tCO2e),

• total emissions (tCO2e),

• Scope 1 (tCO2e),

• Scope 2 (tCO2e), and

• Scope 3 (tCO2e; currently for toll road investments, but roll out across the portfolio is planned).10

Conclusion

The TCFD framework is globally accepted as a way to assess climate-related risks and has proven useful to OMAI. Undertaking climate risk assessments has been and continues to be a learning journey for OMAI. The applicability and value of datasets and tools are often apparent only once they are used. Datasets, tools, and models are most useful if applicable and relevant to the local context. If they are abstracted to a global level, the outcomes are less meaningful.

A key remaining challenge is to gain a deep understanding of the probability of the outcomes and the financial valuation of the outcomes. Establishing an accurate probability is important if we expect investment professionals to use this information to inform and adjust investment decisions.